UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Tuesday Morning Corporation | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

October 7, 2019

Dear Fellow Stockholder:

We are pleased to invite you to attend our 2019 Annual Meeting on November 20, 2019, at 8:30 a.m. (central time) to be held at the Tuesday Morning Corporate Office, 6250 Lyndon B. Johnson Freeway, Dallas, Texas 75240.

Several years ago, we began a transformation of our Company in order to regain our position as a leader in off-price retail. We have executed on a number of critical steps under our business turnaround strategy, primarily focused on driving profitable sales through merchandising and marketing initiatives and operating efficiencies in the supply chain and overall across our business model. In addition, capital allocation and balance sheet management have been priorities with an emphasis on repositioning our real estate portfolio, working capital management and inventory turns.

Fiscal 2019 was an important year for Tuesday Morning. We delivered significant improvement in our operating performance. We increased sales slightly despite significantly reducing our traditional ad events and operating 12 fewer stores. We also made solid progress against our key initiatives including driving improvements in our supply chain, increasing marketing efficiencies and renegotiating our leases. On the merchandising front, we have continued to reorganize our buying organization, adding talent and resources focused on executing our off-price model. We also announced our plan to retrofit our existing, owned Dallas-based distribution center.

Attached is our Notice of Annual Meeting. We have chosen to furnish our proxy statement and annual report to our stockholders over the internet, electronically by email for stockholders who have previously consented to electronic delivery or who have requested to receive the proxy materials by email or, upon request, in printed form by mail. Our proxy statement will instruct you how to vote your shares. Your vote is important. Thank you for your investment in Tuesday Morning.

| Sincerely, | ||

| ||

| Terry Burman | Steven Becker | |

| Chairman of the Board | Chief Executive Officer and President |

TUESDAY MORNING CORPORATION

6250 LBJ Freeway

Dallas, Texas 75240

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held November 15, 201720, 2019

Dear Stockholders:

You are cordially invited to attend the 2017 The 2019 Annual Meeting of Stockholders (the "Annual Meeting") of Tuesday Morning Corporation (the "Company") towill be held at Tuesday Morning Corporation's Headquarters, 6250 LBJ Freeway, Dallas, Texas 75240, on November 15, 201720, 2019 at 8:30 a.m., Centralcentral time. For directions to the Annual Meeting, please write to our Corporate Secretary at Tuesday Morning Corporation, 6250 LBJ Freeway, Dallas, Texas 75240. At the Annual Meeting, ourthe Company will ask the stockholders will be asked to consider and vote on the following matters:to:

This Notice of Annual Meeting, the Proxy Statement for the Annual Meeting and our Annual Report for fiscal 20172019 are being made available to our stockholders on or about October 5, 20177, 2019 on the Internet,internet, electronically by email for stockholders who have previously consented to electronic delivery or who have requested to receive the proxy materials by email or, upon request, in printed form by mail.

Only stockholders of record at the close of business on September 22, 201730, 2019 are entitled to notice of, and to vote at, the Annual Meeting or any postponement or adjournment thereof. If you are the beneficial owner of shares of our common stock held in "street name," you will receive voting instructions from your broker, bank or other nominee (the stockholder of record), which will provide you with details as to how to vote these shares. Additionally, you may vote these shares in person at the Annual Meeting if you have requested and received a legal proxy from your broker, bank or other nominee giving you the right to vote the shares at the Annual Meeting, and you complete the legal proxy and present it to us at the Annual Meeting. Stockholders of record may vote over the Internet,internet, by telephone, by mail if you received a printed set of proxy materials or in person at the Annual Meeting.

Under applicable rules, if you hold your shares in street name, brokers, banks or other nominees will not have discretion to vote these shares on the election of directors the advisory vote on executive compensation and the advisory vote on the frequency of the advisory vote on executive compensation. Accordingly, if your shares are held in street name and you do not submit voting instructions to your broker, bank or other nominee, these shares will not be counted in determining the outcome of these proposals at the Annual Meeting. We encourage you to provide voting instructions to your broker, bank or other nominee if you hold your shares in street name so that your voice is heard on these matters.

Thank you for your continued support of and interest in Tuesday Morning Corporation.

| By Order of the Board of Directors, | ||

Bridgett C. Zeterberg |

Dallas, Texas

October 5, 20177, 2019

Your vote is important. We urge you to review the accompanying Proxy Statement carefully and to submit your proxy as soon as possible so that your shares will be represented at the meeting.

TUESDAY MORNING CORPORATION

6250 LBJ Freeway

Dallas, Texas 75240

PROXY STATEMENT

for the

ANNUAL MEETING OF STOCKHOLDERS

to be held on

Wednesday, November 15, 201720, 2019

This Proxy Statement and the related proxy materials are being furnished to stockholders of Tuesday Morning Corporation, a Delaware corporation, on or about October 5, 2017,7, 2019, on the Internet,internet, electronically by email for stockholders who have previously consented to electronic delivery or who have requested to receive our proxy materials by email, or, upon request, in printed form by mail. The Board of Directors of the Company (the "Board of Directors" or the "Board") is soliciting your proxy for use at the Annual Meeting of Stockholders to be held on November 15, 2017,20, 2019, at 8:30 a.m., Centralcentral time, at our corporate headquarters located at 6250 LBJ Freeway, Dallas, Texas 75240, and at any and all adjournments or postponements thereof (the "Annual Meeting"). For directions to the Annual Meeting, please write to our Corporate Secretary at Tuesday Morning Corporation, 6250 LBJ Freeway, Dallas, Texas 75240. At the Annual Meeting, our stockholders will act upon the matters outlined in the Notice of Annual Meeting of Stockholders and described in more detail in this Proxy Statement.

As used in this Proxy Statement, the terms "Tuesday Morning," "Company," "we," "us," and "our" refer to Tuesday Morning Corporation.

Important Notice Regarding Internet Availability

In accordance with rules adopted by the Securities and Exchange Commission ("SEC"), we may furnish proxy materials, including this Proxy Statement and the Company's 20172019 Annual Report to Stockholders, by providing access to these documents on the Internetinternet instead of mailing a printed copy of our proxy materials to our stockholders. Based on this practice, most of our stockholders have already receivedreceive a Notice of Internet Availability of Proxy Materials (the "Notice"), which provides instructions for accessing our proxy materials on a website referred to in the Notice and for requesting to receive printed copies of the proxy materials by mail or electronically by email.

If you would like to receive a paper or email copy of our proxy materials for our Annual Meeting or for all future meetings, please follow the instructions for requesting such materials included in the Notice. Please note that if you previously requested or consented to delivery of our proxy materials by mail or electronically via email, you did not receive the separate Notice. Instead, we sent you a full set of our proxy materials, which includes instructions for voting on the proposals described in this Proxy Statement. We believe the delivery options that we have chosen allow us to provide our stockholders with the proxy materials they need, while lowering the cost of the delivery of such materials and reducing the environmental impact of printing and mailing paper copies.

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Annual Meeting Information

| Time and Date: | 8:30 a.m., | |

Place: | Tuesday Morning Corporation 6250 LBJ Freeway Dallas, Texas 75240 | |

Record Date: | September | |

Voting: | Only stockholders of record at the close of business on September | |

How to Vote: | If you are a stockholder of record, you may vote over the | |

Attending the Annual Meeting: | All stockholders as of the close of business on the |

Annual Meeting Agenda and Voting Recommendations

Proposal | Board's Voting Recommendation | Page | ||||||

|---|---|---|---|---|---|---|---|---|

| No. 1. | Election of Directors | "FOR" each director nominee | 11 | |||||

| The Company is asking stockholders to elect eight director nominees to the Board. The Board believes that the nominees possess the necessary experience, qualifications, attributes and skills to serve as directors. | ||||||||

No. 2. | Advisory Vote on Executive Compensation | "FOR" | 15 | |||||

| The Company is asking stockholders to approve, on an advisory basis, the compensation for the named executive officers disclosed in these proxy materials. | ||||||||

No. 3. | ||||||||

Ratification of Selection of Independent Registered Public Accounting Firm | "FOR" | 16 | ||||||

| The Company and the Audit Committee are asking stockholders to ratify the engagement of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending June 30, | ||||||||

Board Nominees

The following table provides summary information about each director nominee.

Name | Age | Director Since | Principal Occupation | Committee Memberships | Age | Director Since | Principal Occupation | Committee Memberships | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Terry Burman(1) | 71 | 2013 | Retired Chief Executive Officer of Signet Jewelers Limited | Nominating and Governance (Chair) | 73 | 2013 | Retired Chief Executive Officer of Signet Jewelers Limited | Nominating and Governance (Chair) | ||||||||||||

Steven R. Becker | 50 | 2012 | Chief Executive Officer of Tuesday Morning Corporation | N/A | 52 | 2012 | Chief Executive Officer of Tuesday Morning Corporation | N/A | ||||||||||||

James T. Corcoran(2) | 36 | 2017 | Partner AREX Investment Partners, LP | Audit, Nominating and Governance | ||||||||||||||||

Barry S. Gluck(2) | 65 | 2017 | Off-Price Retail Consultant and retired Executive Vice President of Merchandising, Marketing, and Store Planning and Allocation of Ross Stores Inc. | Nominating and Governance | 67 | 2017 | Off-Price Retail Consultant and retired Executive Vice President of Merchandising, Marketing, and Store Planning and Allocation of Ross Stores Inc. | Compensation, Nominating and Governance | ||||||||||||

Frank M. Hamlin(2) | 49 | 2014 | Executive Vice President and Chief Marketing Officer of Tailored Brands | Audit, Compensation | 51 | 2014 | Executive Vice President, Chief Customer Officer of GameStop Corporation | Audit, Compensation | ||||||||||||

William Montalto | 70 | 2013 | Consultant and retired Executive Vice President and Chief Operating Officer of Sterling Jewelers | N/A | ||||||||||||||||

Reuben E. Slone(2) | 56 | 2019 | Executive Vice President, Supply Chain of Advance Auto Parts, Inc. | Audit | ||||||||||||||||

Sherry M. Smith(2) | 56 | 2014 | Former Chief Financial Officer and Executive Vice President of Supervalu Inc. | Compensation (Chair) | 58 | 2014 | Former Chief Financial Officer and Executive Vice President of SUPERVALU, Inc. | Compensation (Chair) | ||||||||||||

Richard S Willis(2) | 57 | 2012 | Chief Executive Officer and President of Pharmaca Integrative Pharmacies | Audit (Chair), Nominating and Governance | 59 | 2012 | Chief Executive Officer and President of Pharmaca Integrative Pharmacies | Audit (Chair), Nominating and Governance | ||||||||||||

James T. Corcoran(3) | 34 | N/A | Chief Executive Officer of Purple Mountain Capital Partners LLC | N/A | ||||||||||||||||

Corporate Governance Highlights

Financial Review

InFor fiscal 2017, we made tangible progress on each2019, net sales slightly exceeded $1.0 billion, consistent with fiscal 2018 net sales of our strategic priorities, including real estate, merchandising, marketing, supply chain and talent management. In connection with our real estate initiatives, we relocated 52 stores, expanded 13 stores, opened 21 stores and closed 41 stores, for an ending store count of 731. Additionally, we solidified the senior leadership team across key functional areas. However, the Company's fiscal 2017 results were adversely impacted by increased supply chain and freight costs, driven significantly by elevated costs and lower than expected sales resulting from its supply chain issues experienced earlier in the fiscal year as a result of adding the new Phoenix distribution center. Some of our fiscal 2017 business highlights include:

During the fiscal year, we benchmarked our progress against sixour top priorities, which are regularly discussed at executive team meetings and are included in both job performance and short-term incentive plancompensation objectives. Many factors contributed to the positive tone of the business, including the following:

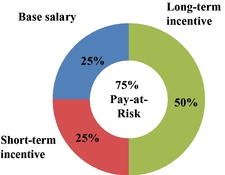

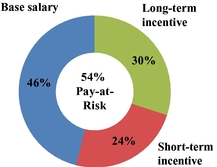

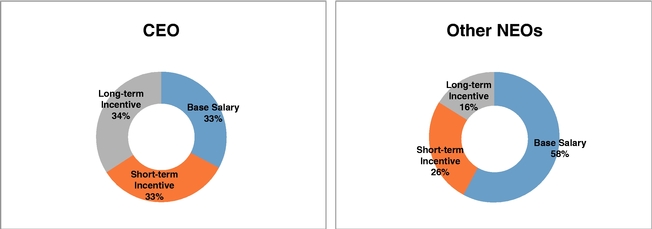

Executive Compensation Highlights

Our executive compensation programphilosophy is designed to motivatepay for the creation of long-term growth and to hold executives accountablevalue for key annual results year-over-year. Theour stockholders. Accordingly, our program is designed to reward performance linked to the creation of stockholder value and to support executive recruitment, engagement and engagement.retention. A significant portion of the executives' total direct compensation is based on the Company's performance and improving stockholder value. This philosophy is reflected in the design of both our short-term cash incentive program as well as theand our long-term equity incentive program. We believe that performance-based compensation and equity compensation better alignsalign the interests of executives and stockholders.

Our strong pay-for-performance philosophy is evidenced by the mixed performance-based pay results for our executives based on actual fiscal 2019 performance. Operating income financial performance over the 12-month measurement period exceeded expectations for the plan year resulting in an annual incentive payout. This is attributed to an extraordinary focus on gross margin improvement and expense control as well as a modest increase in top line sales. However, the comparable sales growth metric was not achieved resulting in no payout for that component of the annual incentive plan. The first 36-month performance cycle of the LTI plan that began on July 1, 2016 and concluded on June 30, 2019 produced below threshold financial results; therefore, those awards were canceled. The Compensation Committee continued to grant long-term incentive awards of flat share amounts equal to the same number of shares awarded in fiscal 2017 and fiscal 2018 rather than returning to market-based dollar value grants of long-term incentive equity.

Some of the compensation "best practices" we employ in furtherance of our philosophy include:

| Compensation Governance—What We Do & What We Don't Do | ||||

✓ | What We Do | ✗ What We Don't Do | ||

| | | | | |

✓ | Annual "Say on Pay" vote |

| ||

| ✗ No discretionary bonuses paid to permanent NEOs when performance results are below threshold | |||

| ✓

| Pay for performance culture, emphasis on performance-based compensation | ✗ No tax gross-up upon change-in-control | ||

| ✓

| Meaningful executive ownership guidelines that create a line of sight between stockholders and executive officers | ✗ No repricing of stock options and no liberal share recycling | ||

| ✓ | Executive equity retention/holding requirements, clawback policy | No across-the-board pay increases | ||

| ✓ | Manage compensation risk by using a variety of financial metrics in pay programs and capping payouts |

| ||

| ✗ No formal non-qualified benefits or perquisite programs | |||

| ✓

| Regular review of | ✗ No hedging or pledging of stock | ||

| ✓

| Use of independent compensation consultant | ✗ No pension or executive SERP | ||

In fiscal 2017, we further enhanced our compensation "best practices" with changes to our equity incentive plan, including:

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

AND VOTING PROCEDURES

Who Can Vote?

The record date for the Annual Meeting iswas September 22, 201730, 2019 (the "Record Date"). Only holders of record of shares of our common stock, par value $0.01 per share (the "Common Stock"), at the close of business on such date are entitled to notice of, and to vote at, the Annual Meeting. Holders of record of Common Stock are entitled to one vote per share on the matters to be considered at the Annual Meeting. At the close of business on the Record Date, 45,844,21647,641,255 shares of Common Stock were issued and outstanding and the holders thereof are entitled to vote at the Annual Meeting.

What Constitutes a Quorum?

In order for any business to be conducted at the Annual Meeting, the holders of at least a majority of the shares of our Common Stock entitled to vote at the Annual Meeting must be represented at the Annual Meeting, either in person or by proxy. Proxies received but marked as

abstentions and broker non-votes (which are described below) will be considered present at the Annual Meeting for purposes of determining a quorum at the Annual Meeting. Although it is not expected, if holders of less than a majority of the shares of our Common Stock are present or represented by proxy at the Annual Meeting, we may adjourn and reschedule the Annual Meeting, without notice other than an announcement at the Annual Meeting, until a quorum is present or represented.

How Do I Vote My Shares?

If you are a stockholder of record, you cannot vote your shares of Common Stock unless you are present at the Annual Meeting or you have previously given your proxy. Written ballots will be provided to anyone who wants to vote in person at the Annual Meeting and is entitled to do so. You can vote by proxy in one of three convenient ways:

Stockholders of record may vote their shares by telephone or over the Internet 24 hoursinternet 24-hours a day, seven days a week. Telephone and Internetinternet votes must be received by 11:59 p.m. Eastern time on November 14, 201719, 2019 and votes by mail must be received on or before the Annual Meeting.

If your shares of Common Stock are held in "street name" by a broker, bank or other nominee, you should have received different voting instructions from your broker, bank or other nominee as to how to vote such shares. These instructions should indicate if Internetinternet or telephone voting is available and, if so, provide details regarding how to use those systems to vote your shares. Additionally, you may vote these shares in person at the Annual Meeting if you have requested and received a legal proxy from your broker, bank or other nominee (the stockholder of record) giving you the right to vote these shares in person at the Annual Meeting.

What Is the Recommendation of the Board of Directors?

The Board unanimously recommends that you vote (1) "FOR" the election of each of the Board's director nominees, (2) "FOR" the approval, on an advisory basis, of the Company's executive compensation, (3) "FOR", on an advisory basis, the option of every"1 YEAR" as the frequency for advisory votes on the Company's executive compensation and (4)(3) "FOR" the ratification of the selection of Ernst & Young LLP ("Ernst & Young") as our independent registered public accounting firm for fiscal 2018.2020.

How Will the Proxies Be Voted?

Where stockholders have appropriately specified how their proxies are to be voted, they will be voted accordingly. If a properly executed proxy does not indicate any voting instructions, the shares of Common Stock represented by such proxy will be voted as follows:

If the Company proposes to adjourn the Annual Meeting, the proxy holders will vote all shares for which they have voting authority in favor of such adjournment. The Board of Directors is not presently aware of any matters other than those stated in the Notice of Annual Meeting of Stockholders and described in this Proxy Statement to be presented for consideration of the Company's stockholders at the Annual Meeting.

Why Did I Receive Multiple Proxy Cards?

Many of our stockholders hold their shares in more than one account and may receive separate proxy cards or voting instruction forms for each of those accounts. To ensure that all of your shares are represented at the Annual Meeting, we recommend that you vote every proxy card that you receive.

How May I Change My Vote or Revoke My Proxy?

If you are a stockholder of record, you may change your vote or revoke your proxy at any time before it is exercised by:

If your shares are held in "street name" through a broker, bank or other nominee, you must contact your broker, bank or other nominee to receive instructions as to how to revoke your proxy if such instructions have not already been provided to you. In any case, your last properly-received and timely votedtimely-voted proxy or ballot will be the vote that is counted.

How Do I Vote My Shares Held in Street Name?

If you are the beneficial owner of shares held in "street name" and do not submit voting instructions to your broker, bank or other nominee, under the applicable rules, the broker, bank or other nominee that holds your shares may use its discretion in voting your shares with respect to "routine items" but not with respect to "non-routine items." On non-routine items for which you do not submit voting instructions to your broker, bank or other nominee, these shares will not be voted and will be treated as "broker non-votes." The proposal to ratify the selection of Ernst & Young as our independent registered public accounting firm for fiscal 20182020 is considered a routine item and, therefore, may be voted upon by your broker, bank or other nominee if you do not provide voting instructions on this proposal. However, the election of directors and the advisory vote on executive compensation and the

advisory vote on the frequency of advisory votes on executive compensation are considered non-routine items. Accordingly, if your shares are held in street name and you do not provide voting instructions to your broker, bank or other nominee, these shares will not be counted in determining the outcome of these proposals at the Annual Meeting. We encourage you to provide voting instructions to your broker, bank or other nominee if you hold your shares in street name so that your voice is heard on these matters.

How Many Votes Must Each Proposal Receive to be Adopted?

Assuming the presence of a quorum, the following vote is required for each proposal:

ratification at the Annual Meeting with a view towards soliciting the opinion of the Company's

stockholders, which the Audit Committee will take into consideration in future deliberations. If the selection of Ernst & Young as the Company's independent registered public accounting firm is not ratified at the Annual Meeting, the Audit Committee may consider the engagement of another independent registered public accounting firm, but will not be obligated to do so. Abstentions are considered to be "present" and "entitled to vote" at the Annual Meeting with respect to this proposal, and as a result, abstentions will have the same effect as a vote against this proposal. As discussed above, under applicable rules, brokers, banks and other nominees may use their discretion to vote shares of Common Stock held in "street name" for which voting instructions are not submitted with respect to the ratification of the selection of Ernst & Young, so no broker non-votes are expected for this proposal.

Who Is Soliciting this Proxy?

The Board of Directors is soliciting this proxy. The Company will bear the cost of the solicitation of proxies by the Board of Directors. The Company's directors, and certain of the Company's officers and employees in the ordinary course of their employment, may solicit proxies by mail, Internet,internet, telephone, facsimile, personal contact, email or other online methods. We will reimburse their expenses in connection therewith. We also will reimburse banks, brokers, custodians, nominees or fiduciaries for reasonable expenses they incur in sending these proxy materials to you if you are a beneficial holder of our shares. Other proxy solicitation expenses that we will pay include those for preparing, mailing, returning and tabulating proxies.

The costs of soliciting proxies pursuant to this Proxy Statement will be paid by the Company. Solicitation may be made in person or by telephone, email, mail or facsimile by our directors, officers or employees. The Company has also engaged Okapi Partners, a proxy solicitation firm, to assist in the solicitation of proxies for a fee of $30,000. The total amount to be spent for the Company's solicitation of proxies from stockholders, including the estimated cost of $77,000 in connection with settling the contested election with the Jeereddi/PMCP Group (as defined below), for the Annual Meeting is estimated to be approximately $277,000, of which $277,000 has been incurred to date.

How May I Attend the Annual Meeting?

All stockholders as of the Record Date, or their duly appointed proxies, may attend the Annual Meeting. Please note that if you hold your shares in "street name" through a broker, bank or other nominee, you will need to bring a legal proxy from your broker, bank or other nominee (the stockholder of record) or a brokerage statement reflecting your stock ownership as of the Record Date and check in at the registration desk at the Annual Meeting.

When Will the Voting Results Be Announced?

The preliminary voting results are expected to be announced at or shortly following the Annual Meeting. We will report the final voting results, or the preliminary voting results if the final voting results are unavailable, in a Current Report on Form 8-K to be filed with the SEC within four business days after the Annual Meeting. You may obtain a copy of this Form 8-K by visiting the SEC's website atwww.sec.gov or our website atwww.tuesdaymorning.com, under "Investor Relations—Financial Info—SEC Filings."

RESOLUTION OF STOCKHOLDER NOMINATIONS

Background

On August 8, 2017, the Company received a letter from Naveen Jeereddi of Jeereddi Investments LP (together with certain of its affiliates, "Jeereddi") and James T. Corcoran of Purple

Mountain Capital Partners LLC (together with certain of its affiliates, "Purple Mountain," and Purple Mountain together with Jeereddi, the "Jeereddi/PMCP Group") indicating that the Jeereddi Group intended to nominate a slate of three director candidates to stand for election to the Board at the Annual Meeting (the "Initial Letter"). In addition, the Initial Letter reflected the Jeereddi/PMCP Group's view that Steven Becker, the Company's Chief Executive Officer, should be replaced by Michael Barnes.

Between August 8, 2017 and August 17, 2017, representatives of the Company held discussions with members of the Jeereddi/PMCP Group to discuss their concerns.

On August 18, 2017, Jeereddi II, LP delivered a notice to the Company indicating its intent to nominate three candidates, which included Mr. Corcoran, Mr. Barnes, and R. Michael Rouleau, the Company's former Chief Executive Officer (collectively, the "Jeereddi/PMCP Candidates"), to stand for election to the Board at the Annual Meeting (the "Notice").

Between August 18, 2017 and September 24, 2017, the Board held meetings to discuss the Jeereddi/PMCP Candidates and the composition of the Board and instructed representatives of the Company to continue to engage with the Jeereddi/PMCP Group. During this time, representatives of the Company and of the Jeereddi/PMCP Group continued to engage in discussions to explore ways to reach an agreement to avoid the distractions of a contested election, but could not reach an agreement at such time.

On September 25, 2017, the Jeereddi/PMCP Group delivered a letter to the Company withdrawing its nomination of Mr. Rouleau.

Later on September 25, 2017, the Company filed with the SEC its preliminary proxy statement in connection with the Annual Meeting.

Between September 25, 2017 and September 31, 2017, representatives of the Company and of the Jeereddi/PMCP Group continued to engage in discussions regarding a potential agreement to settle the contested election for directors at the Annual Meeting.

On October 1, 2017, the Company and the Jeereddi/PMCP Group entered into a cooperation agreement (the "Cooperation Agreement") to settle the contested election for directors at the Annual Meeting.

On October 2, 2017, the Company and the Jeereddi/PMCP Group issued a joint press release announcing their entrance into the Cooperation Agreement.

Cooperation Agreement with the Jeereddi/PMCP Group

Pursuant to the terms of the Cooperation Agreement, the Company agreed to nominate James T. Corcoran for election to the Board at the 2017 Annual Meeting. If elected, Mr. Corcoran will be appointed to the Nominating and Governance Committee. Mr. Corcoran's nomination will fill a vacancy created by the retirement of Jimmie L. Wade, effective as of immediately following the 2017 Annual Meeting. Under the terms of the Cooperation Agreement, Mr. Corcoran will offer his resignation to the Board if at any time the Jeereddi/PMCP Group no longer beneficially owns at least 533,344 shares of the Company's common stock (subject to adjustment for stock splits, reclassifications, combinations and similar adjustments, the "Minimum Ownership Threshold"). In addition, so long as the Jeereddi/PMCP Group meets the Minimum Ownership Threshold, the Jeereddi/PMCP Group will be entitled to certain replacement rights during the Standstill Period (as defined below) in the event Mr. Corcoran is unable to serve as a director.

Also under the terms of the Cooperation Agreement, Jeereddi II agreed to irrevocably withdraw its notice of nomination of candidates for election at the 2017 Annual Meeting previously submitted to the Company on August 18, 2017. In addition, each member of the Jeereddi/PMCP Group agreed that

it will not, directly or indirectly, (i) nominate or recommend for nomination any person for election at the 2017 Annual Meeting or at the 2018 annual meeting of stockholders (the "2018 Annual Meeting"), (ii) submit proposals for consideration or otherwise bring any business before the 2017 and 2018 Annual Meetings, or (iii) engage in certain activities related to "withhold" or similar campaigns with respect to the 2017 and 2018 Annual Meetings.

The Cooperation Agreement also provides that at the 2017 and 2018 Annual Meetings, each member of the Jeereddi/PMCP Group will cause all shares of the Company's common stock beneficially owned by them to be present and voted (i) in favor of all of the directors nominated for election by the Board, (ii) in favor of the appointment of the Company's independent registered accounting firm for the years ended June 30, 2017 and June 30, 2018, respectively, and (iii) in accordance with the Board's recommendation with respect to the Company's "say-on-pay" proposal,provided,however, that to the extent that the recommendation of both Institutional Shareholder Services Inc. ("ISS") and Glass Lewis & Co., LLC ("Glass Lewis") differs from the Board's recommendation with respect to any matter other than nominees for election as directors to the Board, the Jeereddi/PMCP Group shall have the right to vote in accordance with the recommendation of ISS and Glass Lewis with respect to such matters.

Further, under the terms of the Cooperation Agreement, each member of the Jeereddi/PMCP Group agreed to certain normal and customary standstill provisions during a standstill period, which is defined as the period beginning on the date of the Cooperation Agreement and through the later of (x) the date that is the first day to submit stockholder nominations for the 2019 annual meeting of stockholders pursuant to the Company's Bylaws (the "2019 Advance Notice Date") and (y) the date that Mr. Corcoran no longer serves on the Board;provided,however, that if Mr. Corcoran is not re-nominated by the Board for election at the 2018 Annual Meeting, the Standstill Period shall end thirty (30) days following the conclusion of the 2018 Annual Meeting; andprovided,further, that if Mr. Corcoran resigns for any reason prior to the 2019 Advance Notice Date, the Standstill Period shall continue until the 2019 Advance Notice Date (the "Standstill Period").

Among other things, the standstill provisions provide that, during the Standstill Period, each member of the Jeereddi/PMCP Group will not, among other things, solicit proxies or consents regarding any matter to come before any annual or special meeting of stockholders, or enter into a voting agreement or any group with stockholders other than affiliates of the Jeereddi/PMCP Group and current group members. In addition, each member of the Jeereddi/PMCP Group will not seek to make, or encourage any third party in making, any offer or proposal with respect to any tender offer, merger, acquisition, amalgamation, recapitalization, restructuring, disposition, spin-off, asset sale, joint venture or other business combination involving the Company and will not seek, or encourage any person, to submit nominees in furtherance of a contested solicitation for the election or removal of directors.

Each of the parties also agreed to certain mutual non-disparagement obligations, and the Company agreed to reimburse the Jeereddi/PMCP Group for its reasonable, documented out-of-pocket fees and expenses, including legal expenses, occurred in connection with the matters related to the negotiation and execution of the Cooperation Agreement, up to a maximum of $25,000.

The foregoing is not a complete description of the Cooperation Agreement. For a further description of the Cooperation Agreement and a copy of the Cooperation Agreement, please see our Current Report on Form 8-K that we filed with the SEC on October 2, 2017.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

At the Annual Meeting, the holders of Common Stock as of the Record Date will consider and vote upon the election of eight directors. The Board has nominated Terry Burman, Steven R. Becker, James T. Corcoran, Barry S. Gluck, Frank M. Hamlin, William Montalto,Reuben E. Slone, Sherry M. Smith, and Richard S Willis and James T. Corcoran for election as directors of the Company. Each of Terry Burman, Steven R. Becker, James T. Corcoran, Barry S. Gluck, Frank M. Hamlin, William Montalto,Reuben E. Slone, Sherry M. Smith, and Richard S Willis are currently serving as our directors, and each has agreed to stand for re-election to our Board. Jimmie L. Wade has informed the Board that he will retire from the Board, effective immediately following the Annual Meeting. The Board thanks Mr. Wade for his years of service to the Company. Under the terms of the Cooperation Agreement, the Board has nominated James T. Corcoran for election to the Board, and Mr. Corcoran's nomination will fill the vacancy created by Mr. Wade's retirement. Mr. Corcoran has agreed to stand for election to our Board.

If they are elected, each of the nominees will continue to serve until their successors are duly elected and qualified at the next annual meeting of stockholders, or until their earlier death, resignation or removal. Should any nominee become unable or unwilling to accept nomination for election, which is not currently anticipated, the Board may designate a substitute nominee or reduce the number of directors accordingly. The proxy holders will vote for any substitute nominee designated by the Board. Each of the Board's nominees has indicated his or her willingness to serve the full term.

The following is biographical information about each of the nominees to the Board of Directors, including the specific experience, qualifications, attributes and skills of the nominees that led to the conclusion that each of the nominees should serve as a director of the Company, in light of the Company's business and structure:

Terry Burman, age 71, has served73, joined the Board of Tuesday Morning as a director of Tuesday Morning sincein February 2013, and has served as Chairman of the Board of the Company since December 2015. Prior to that, Mr. Burman served as Lead Independent Director and a member of the Office of the Chairman from September 2015 to December 2015. Mr. Burman has served as the Non-Executive Chairman of the Board of Abercrombie & Fitch Co., a clothing retailer, since February 2018 and prior to that as Lead Independent Director since May 2017 and on the Board of Directors of Abercrombie & Fitch Co. since January 2014. He has been a director of Learning Care Group, a privately-held company operating over 900 learning and daycare centers in the United States, since July 2014. He has been a board member of the St. Jude Children's Research Hospital Board of Governors since July 2004 and served as Chairman of the Board from July 2013 to June 2015. Mr. Burman has also served as a board member of ALSAC, the fundraising organization of St. Jude, since July 2004 and on the Board of Trustees of the Norman Rockwell Museum since September 2016. Mr. Burman served as Chairman of the Board and a director of Zale Corporation, a jewelry retailer, from May 2013 until it was acquired in May 2014 and served on the Board of Directors of YCC Holdings LLC, a retailer of candles, fragrances and other products, from October 2007 until it was acquired in October 2013. From March 2001 to January 2011, Mr. Burman was the Chief Executive Officer of Signet Jewelers Limited ("Signet"), a specialty jewelry retailer. Mr. Burman joined Signet in 1995 as the Chairman and CEO of Sterling Jewelers, Inc., a U.S. division of Signet. BeforeMr. Burman also served on the Board of Directors of Signet until January 2011. Prior to joining Signet, Mr. Burman held various senior executive positions of increasing responsibility with Barry's Jewelers, Inc., a specialty jewelry retailer,which now does business as Samuels Jewelers, from 1980 to 1995, including President and Chief Executive Officer from 1993 to 1995. Prior to that, Mr. Burman was a partner with Roberts Department Stores, a regional department store chain specializing in apparel. Mr. Burman has served as the Lead Independent Director of Abercrombie & Fitch Co., a clothing retailer, since May 2017 and on the board of directors of Abercrombie & Fitch Co., since January 2014 and Learning Care Group, the second largest provider of early childhood care and education services in the U.S., since July 2014. Mr. Burman also served on the board of directors of Signet until January 2011. Mr. Burman served on the board of directors of YCC Holdings LLC, a retailer of candles, fragrances and other products, from October 2007 until it was acquired in October 2013, and served as chairman of the board and a director of Zale Corporation, a jewelry retailer, from May 2013 until it was acquired in May 2014. In nominating Mr. Burman to serve as a director of the Company, the Board of Directors considered his extensive executive, financial and management expertise and experience, his experience as a chief executive officer in the retail industry, his significant international management experience, and his general business and financial acumen.

Steven R. Becker, age 50,52, has served as a director of Tuesday Morning since July 2012 and was appointed its Chief Executive Officer in December 2015. Prior to becoming CEO of Tuesday Morning, Mr. Becker served as Chairman of the Board of the Company from July 2012 until September 2015 and as Executive Chairman and head of the Office of the Chairman from September 2015 until December 2015. Prior to becoming CEO of Tuesday Morning, Mr. Becker spent 20 years in the

investment management industry with a focus on investing in middle market public companies. Mr. Becker has extensive public company board experience having previously served as a board member at a variety of public companies including, Hot Topic, Inc., an apparel retailer, Ruby Tuesday, a national restaurant company, Emcore, a semiconductor producer, Plato Learning, an educational software Company,company, Pixelworks, a semiconductor producer, Fuel Systems Solutions, a manufacturer of alternative energy systems, and Special Diversified Opportunities, a holding company that owns businesses in a variety of industries, among others. Prior to becoming CEO of Tuesday Morning, Mr. Becker was the co-managing partner at Becker Drapkin Asset Management, whose predecessor,

Greenway Capital, he founded in 2005. From 1997 to 2004, Mr. Becker was a partner at Special Situations Funds, a New York City-basedCity based asset manager. Prior to joining Special Situations Funds, Mr. Becker was a part of the distressed debt and leveraged equities research team at Bankers Trust Securities. Mr. Becker began his career at Manley Fuller Asset Management in New York as a small cap analyst. In nominating Mr. Becker to serve as a director of the Company, the Board of Directors considered the insights Mr. Becker brings through his prior service as a director of ourthe Company, his demonstrated leadership and experience as our Chief Executive Officer and his extensive financial experience, in both public and private companies, which provides the Board with valuable expertise in corporate finance, strategic planning, and corporate governance.

James T. Corcoran, age 36, has served as a director of Tuesday Morning since November 2017. He is a Partner at AREX Investment Partners, LP, an investment management firm focused on special situations. He founded and remains Chief Executive Officer of Purple Mountain Capital Partners LLC, a private investment firm, from 2017 to 2019. Prior to founding Purple Mountain Capital Partners LLC, he served as a Principal at Highfields Capital Management, a value-oriented investment management firm in Boston, from 2010 to 2016. Mr. Corcoran worked as an investment banking analyst for Credit Suisse (USA), Inc. in its leveraged finance and restructuring group, from 2006 to 2008, in addition to working in its hedge funds investment group, from 2005 to 2006. Mr. Corcoran received his MBA from the Harvard Business School and his AB with honors in Economics and Political Science from the University of Chicago and is a CFA charterholder. Mr. Corcoran was nominated by the Board pursuant to the terms of a Cooperation Agreement entered into with certain Company stockholders to settle a contested election for directors at the 2017 annual meeting of stockholders for the Company. See "Cooperation Agreement" below for additional information.

Barry S. Gluck, age 65,67, has served as a director of Tuesday Morning since January 2017. Mr. Gluck served in various Senior Managementsenior management positions with Ross Stores Inc. ("Ross") from 1989 to 2007, most recently as Executive Vice President of Merchandising, Marketing and Store Planning and Allocation. Prior to joining Ross, Mr. Gluck was with Today's Man as Vice President, General Merchandise Manager and Chief Merchandising Officer and with Macy's Department Stores as Vice President Divisional Merchandising Manager. Since 2012, Mr. Gluck has served as the Founder and Managing Director of Gluck Consulting LLC, a management consultant group which focuses primarily on off-price/value channels. In nominating Mr. Gluck to serve as a director of the Company, the Board considered his 30-years32 years of off-price and value channel experience, his extensive executive, marketing and management expertise having served as a chief merchandising officer in the retail industry, and his general business and financial acumen.

Frank M. Hamlin, age 49,51, has served as a director of Tuesday Morning since April 2014. Mr. Hamlin hasis currently Executive Vice President, Chief Customer Officer of GameStop Corporation ("GameStop"), a global, multichannel video game, consumer electronics and wireless services retailer. Mr. Hamlin had previously served as Chief Marketing Officer of GameStop from June 2014 to August 2016. Mr. Hamlin served as Chief Marketing Officer of Spence Diamonds from May 2018 to August 2018 and as Executive Vice President and Chief Marketing Officer for Tailored Brands, Inc. since September 6, 2017. From June 2014 to August 26, 2016 Mr. Hamlin served as Chief Marketing Officer of GameStop Corp., a global, multichannel video game, consumer electronics and wireless services retailer.leading national menswear retailer from September 2017 to May 2018. Mr. Hamlin previously served as Executive Vice President and GM, Marketing and E-Commerce of Guitar Center, Inc., a musical instruments retailer, from June 2010 until May 2014, and as Executive Vice President and Chief Operating Officer of E-Miles, LLC, an interactive marketing company, from February 2007 to June 2010. From July 2004 until February 2007, he was Director of Marketing, Central Market Division for H.E. Butt Grocery, a fresh, specialty and prepared foods retailer. Prior to that time, Mr. Hamlin held various positions with Brierley & Partners, E-Rewards, Inc., Arista Records and The Walt Disney Company. In nominating Mr. Hamlin to serve as a director of the Company, the Board of Directors considered the various senior executive-level positions he haspreviously held with retail service companies, as well as his extensive experience in marketing, branding strategy and customer engagement.

William MontaltoReuben E. Slone,, age 70,56, has served as a director of Tuesday Morning since June 2013.2019. Mr. Montalto served as a consultant to Tuesday Morning pursuant to a consulting agreementSlone is currently Executive Vice President, Supply Chain at Advance Auto Parts, Inc. (NYSE: AAP) and sat on the Board of Directors from July 1,March 2016 to October 31, 2016.2018. Mr. Slone is a seasoned supply chain executive with experience across multiple consumer-facing industry sectors at best-in-class companies. Previous to Advance Auto Parts Inc., Mr. Slone was Senior Vice President, Supply Chain at Walgreens, a pharmaceutical retailer from May 2012 to October 2018. From November 2004 until May 2012, Mr. Slone was Executive Vice President, Supply Chain, and General Manager, Services at Office Max. From April 2000 to November 2004, Mr. Slone held various positions at Whirlpool Corporation including Vice President Global Supply Chain, Vice President North American Region Supply Chain and Vice President, Global eBusiness. From February 1997 to March 2000, Mr. Slone was eGM Director, Global eSales and Director, Global Manufacturing Strategic Process and System Alignment at General Motors Corporation. Prior to that from January 1, 2016 through June 30, 2016,time, Mr. Montalto was an employee of Tuesday Morning in an interim position as Assistant to the Chief Executive Officer to assist in the search and hiring of the Chief Information Officer and Head of Supply Chain. From August 20, 2015 through December 31, 2015, Mr. Montalto served as a consultant to Tuesday Morning. Mr. Montalto served inSlone held various positions with Sterling Jewelers, the U.S. division

of Signet, a specialty jewelry retailer, from 1986 to 2012. Mr. Montalto served as Executive Vice PresidentFederal-Mogul Corporation, Electronic Data Systems, Ernst & Young and Chief Operating Officer of Sterling Jewelers from 2006 until his retirement in June 2012, and he previously served as Executive Vice President and Chief Administrative Officer of the division from 2002 until 2006 and in various other capacities with the division prior to 2002. Prior to joining Sterling, Mr. Montalto served as a retail management consultant for Coopers & Lybrand (now PricewaterhouseCoopers) from 1980 to 1986, where he led significant systems planning and development consulting engagements for a variety of major retailers.Engineering Technology LTD. In nominating Mr. MontaltoSlone to serve as a director of the Company, the Board of Directors considered his operational expertiseleadership qualities developed from his experience while serving as a senior supply chain executive with Advance Auto Parts, Walgreens, Office Max and extensive knowledge in all aspects of retailing including information technology, real estateWhirlpool, his other board experience, as well as his general business and marketing.financial acumen.

Sherry M. Smith, age 56,58, has served as a director of Tuesday Morning since April 2014. Ms. Smith served in various positions with SupervaluSUPERVALU, Inc., a grocery retailer and food distributor, from 1987 to 2013. Ms. Smith served as Chief Financial Officer and Executive Vice President of Supervalu Inc.SUPERVALU, Inc.. from December 2010 until August 2013, and she previously served as Senior Vice President, Finance from 2006 until 2010, Senior Vice President, Finance and Treasurer from 2002 until 2005, and in various other capacities with SupervaluSUPERVALU, Inc. prior to 2002. Prior to joining Supervalu Inc., Ms. Smith held various positions with McGladrey LLP, a public accounting firm. Ms. Smith has served on the boardBoard of directorsDirectors of Deere & Company, a manufacturer and distributor of agricultural, turf, construction and forestry equipment, since December 2011, and currently serves as a member of the audit committee and finance committee. Ms. Smith has also served on the boardBoard of directorsDirectors of Realogy Holdings Corporation since December 2014, and currently serves on its audit committee and nominating and governance committee. Ms. Smith has served on the boardBoard of directorsDirectors of Piper Jaffrey Corp since January 2016, and currently serves on its compensation committee and audit committee. SinceFrom January 2015 to December 2018, Ms. Smith has served on the Financial Accounting Standards Advisory Council (FASAC), a group that advises the Financial Accounting Standards Board (FASB) on strategic issues, project priorities and other matters. In nominating Ms. Smith to serve as a director of the Company, the Board of Directors considered her leadership qualities developed from her experience while serving as a senior executive and as Chief Financial Officer of SupervaluSUPERVALU, Inc., the breadth of her experiences in auditing, finance, accounting, compensation, strategic planning, and other areas of oversight, and her subject matter knowledge in the areas of finance and accounting and other board experience.

Richard S Willis, age 57,59, has served as a director of Tuesday Morning since July 2012. Since January 2016, Mr. Willis has served as the Chief Executive Officer, President and a Director of Pharmaca Integrative Pharmacies, an innovative retail pharmacy that combines traditional pharmacy services with natural health and beauty products and expert practitioners. From September 2011 through December 2015, Mr. Willis served as the President, and Chief Executive Officer and as a director of Speed Commerce, Inc. (formerly Navarre Corporation), one of the nation's largest omni channel, pure play, end-to-end e-commerce solution providers. Mr. Willis previously served as the Executive Chairman of Charlotte Russe, a mall-based specialty retailer of fashionable, value-priced apparel and accessories, from January 2011 to September 2011. From 2009 to 2011, Mr. Willis served as President of Shoes for Crews, a seller of slip resistant footwear. From 2003 to 2007, Mr. Willis was President and Chief Executive Officer of Baker & Taylor Corporation, a global distributor of books, DVDs and music. Previously, Mr. Willis served as Chairman, President and Chief Executive Officer of Troll Communications and President and Chief Executive Officer of Bell Sports. Mr. Willis served four terms

as Chairman of the Board of Regents at Baylor University. In nominating Mr. Willis to serve as a director of the Company, the Board of Directors considered his considerable executive leadership experience across multiple industries, including distribution businesses that serve retailers and their suppliers, and his significant expertise in operating businesses and directing transformative plans, including executive level experiences of more than 20 years in retail and manufacturing industries.

James T. Corcoran, age 34, is a new nominee and is not currently a director of the Company. He has served as the founder and Chief Executive Officer of Purple Mountain Capital Partners LLC, a private investment firm, since June 2017. Prior to founding Purple Mountain Capital Partners LLC, he served as a Principal at Highfields Capital Management, a value-oriented investment management firm in Boston, from 2010 to 2016. Mr. Corcoran worked as an investment banking analyst for Credit Suisse (USA), Inc. in its leveraged finance and restructuring group, from 2006 to 2008, in addition to working in its hedge funds investment group, from 2005 to 2006. Mr. Corcoran received his MBA from the Harvard Business School and his AB with honors in Economics and Political Science from the University of Chicago and is a CFA charterholder. Mr. Corcoran is being nominated by the Board pursuant to the terms of the Cooperation Agreement.

The Board of Directors unanimously recommends that you vote "FOR" the election of each of the Board's nominees.

PROPOSAL NO. 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As required by Section 14A of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), the Company is asking stockholders to approve, on an advisory basis, the compensation for the named executive officers ("NEOs") disclosed in these materials. This proposal, commonly referred to as a "say on pay" proposal, gives stockholders the opportunity to express their views on the compensation of the named executive officers.NEOs.

The vote on this resolution is not intended to address any specific element of compensation. Rather, the vote relates to the compensation of our named executive officers,NEOs, as described in this Proxy Statement in accordance with the compensation disclosure rules of the SEC. The vote is advisory, which means that the vote is not binding on the Company, our Board of Directors or the Compensation Committee of the Board. The Company currently submits the compensation of named executive officersNEOs to an advisory vote of stockholders on an annual basis.

As described in more detail below under the heading "Executive Compensation—Compensation Discussion and Analysis," our executive compensation program is designed to motivate our executives to create a successful company. We believe that our compensation program, with its balance of short-term incentives (including performance-based cash bonus awards) and long-term incentives (including equity awards that vest over certain time periods and performance-based equity awards), rewards sustained performance that is aligned with long-term stockholder interests. Please read the "Compensation Discussion and Analysis," compensation tables and narrative discussion sections of this Proxy Statement below for additional details about our executive compensation program, including information about the fiscal 20172019 compensation of our named executive officers.NEOs.

We believe a significant amount of total compensation should be in the form of short-term and long-term incentive awards to align compensation with our financial and operational performance goals as well as individual performance goals. We continually evaluate the individual elements of our executive compensation program in light of market conditions and governance requirements and make changes where appropriate for our business. We believe that the core of our executive compensation program provides opportunities to reward high levels of individual and Company performance and will help drive the creation of sustainable stockholder value.

The Compensation Committee, which is responsible for determining the compensation of our executive officers, is comprised solely of non-employee directors who satisfy the independence requirements under NASDAQ rules and will continue to emphasize responsible compensation arrangements that attract, retain, and motivate high caliber executives to achieve the Company's business strategies and objectives.

Accordingly, we ask our stockholders to vote on the following resolution at the Annual Meeting:

"RESOLVED, that the Company's stockholders approve, on an advisory basis, the compensation paid to the Company's named executive officers,NEOs, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion."

The Board of Directors unanimously recommends that you vote "FOR" the approval of the compensation of the Company's named executive officers,NEOs, as disclosed in this Proxy Statement.

PROPOSAL NO. 3ADVISORY VOTE ON THE FREQUENCY OFAN ADVISORY VOTE ON EXECUTIVE COMPENSATION

In addition to requiring an advisory vote on executive compensation, Section 14A of the Exchange Act also requires that at least once every six years, we provide stockholders with the opportunity to vote on how frequently we should seek future advisory votes on executive compensation. In 2011, our Board of Directors recommended and our stockholders voted overwhelmingly in favor of holding an annual advisory vote on executive compensation.

By voting with respect to this proposal, stockholders may indicate whether they would prefer that we conduct future advisory votes on executive compensation once every one, two, or three years. Stockholders also may, if they desire, abstain from casting a vote on this proposal.

The Board of Directors has determined that an annual advisory vote on executive compensation will allow our stockholders to provide timely, direct input on the Company's executive compensation philosophy, policies and practices as disclosed in the proxy statement each year. The Board of Directors believes that an annual vote is therefore consistent with the Company's efforts to engage in an ongoing dialogue with our stockholders on executive compensation and corporate governance matters.

Our Compensation Committee carefully considers executive compensation program decisions each year, taking stockholder feedback into account in making these decisions. Accordingly, the Board of Directors believes that an annual advisory vote on executive compensation is an important part of our executive compensation process.

This vote is advisory and not binding on the Company or the Board of Directors. The Board of Directors and the Compensation Committee will take into account the outcome of the vote, however, when considering the frequency of future advisory votes on executive compensation.

The Board of Directors unanimously recommends that you vote for the option of every "1 YEAR" as the preferred frequency for advisory votes on executive compensation.

PROPOSAL NO. 4

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

On September 19, 2017,10, 2019, the Audit Committee selected Ernst & Young as the Company's independent registered public accounting firm for the fiscal year ending June 30, 2018.2020. Although SEC regulations and the NASDAQ listing requirements require the Company's independent registered public accounting firm to be engaged, retained and supervised by the Audit Committee, the selection is being submitted for ratification at the Annual Meeting with a view towards soliciting the opinion of the Company's stockholders, which the Audit Committee will take into consideration in future deliberations. If the selection of Ernst & Young as the Company's independent registered public accounting firm is not ratified at the Annual Meeting, the Audit Committee may consider the engagement of another independent registered public accounting firm, but will not be obligated to do so. The Audit Committee may terminate the engagement of Ernst & Young as the Company's

independent registered public accounting firm without the approval of the Company's stockholders if the Audit Committee deems termination to be necessary or appropriate. The Company expects that representatives of Ernst & Young will be present at the Annual Meeting to respond to appropriate questions and will have an opportunity to make a statement if they desire to do so.

The Board of Directors unanimously recommends that you vote "FOR" the ratification of the selection of Ernst & Young as the Company's independent registered public accounting firm for the fiscal year ending June 30, 2018.2020.

Director Nomination

The Nominating and Governance Committee of the Board of Directors is responsible for providing oversight as to the identification, selection and qualification of candidates to serve as directors of the Company and will recommend to the Board candidates for election or re-election as directors (or to fill any vacancies on the Board). The members of the Nominating and Governance Committee are Terry Burman, as Chair, Richard S Willis, Barry S. Gluck and Richard S Willis.James T. Corcoran. Each of the members of the Nominating and Governance Committee is an independent director under applicable NASDAQ rules. The Nominating and Governance Committee Charter is available on the Company's website atwww.tuesdaymorning.com under "Investor Relations—Corporate Governance—Corporate Governance Documents." The Nominating and Governance Committee Charter is also available in print to any stockholder who requests a copy from the Secretary of the Company at 6250 LBJ Freeway, Dallas, Texas 75240.

In identifying and evaluating nominees for director, the Nominating and Governance Committee will take into account the following attributes and qualifications: (1) relevant knowledge and mix of background and experience; (2) personal and professional ethics, integrity and professionalism; (3) accomplishments in their respective fields; (4) the skills and expertise to make a significant contribution to the Board, the Company and its stockholders; and (5) whether the candidate has any of the following qualities: financial expertise, general knowledge of the retail industry, and Chief Executive Officer, Chief Financial Officer or other senior management experience. In addition, although the Nominating and Governance Committee does not have a formal diversity policy in place for the director nomination process, diversity is an important factor in the Nominating and Governance Committee's consideration and assessment of a candidate, with diversity being broadly construed to mean a variety of opinions, perspectives, experiences and backgrounds, including gender, race and ethnicity differences, as well as other differentiating characteristics, all in the context of the requirements of the Board at that point in time. In addition, no person may be considered as a candidate for nomination as a director of the Company if (i) during the last ten years, that person, or

any of his or her affiliates, has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors), or is currently under investigation for same or (ii) during the last ten years, that person, or any of his or her affiliates, was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which that person, or any of his or her affiliates, was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws on finding any violation with respect to such laws, or is currently under investigation for same. In addition, the Nominating and Governance Committee will recommend to the Board candidates for re-election as directors. The Nominating and Governance Committee may conduct all necessary and appropriate inquiries into the backgrounds and qualifications of potential candidates. There are no specific or minimum qualities a candidate must have to be recommended as a director nominee by the Nominating and Governance Committee.

The process for evaluating candidates is the same regardless of the source of the recommendation. The Nominating and Governance Committee will not discriminate on the basis of race, color, national origin, gender, religion, sexual orientation or disability in selecting nominees. In addition to those candidates identified

through its own internal processes, the Nominating and Governance Committee will evaluate a candidate proposed by any single stockholder (or group of stockholders) that beneficially owns our Common Stock provided that the information regarding the potential candidate or candidates has been timely given to the Company. In order to be considered by the Nominating and Governance Committee for evaluation for an upcoming annual meeting of stockholders, a notice from a stockholder regarding a potential candidate must be sent to the Company's Secretary at the Company's headquarters by the date specified in the "Stockholders' Proposals" section of the previous year's proxy statement for notice of the intention to nominate directors at the meeting. The notice should set forth (a) as to each person whom the stockholder proposes as a potential candidate for director, (i) the name, age, business address and residence address of such person, (ii) the principal occupation or employment of such person, (iii) the class and number of shares of the Company that are beneficially owned by such person, and (iv) any other information relating to such person that is required to be disclosed in solicitations of proxies for election of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act (including without limitation such person's written consent to being named in the proxy statement as a nominee and to serving as a director if elected); and (b) as to the stockholder giving the notice, (i) the name and address of the stockholder of record, as they appear on the Company's books, of the beneficial owners, if any, and, if such stockholder or beneficial owner is an entity, the persons controlling such entity, proposing such nomination, (ii) the class and number of shares of the Company which are held of record and beneficially by such stockholder and control persons and a description of certain agreements, arrangements or understandings among the stockholder, beneficial owners or control persons (and a representation to notify the Company of any such agreements, arrangements or understandings in effect as of the record date of the meeting), (iii) a representation that the stockholder is entitled to vote at the meeting and intends to appear at the meeting in person or by proxy, and (iv) a representation whether the stockholder or the beneficial owner or control person, if any, will engage in a solicitation with respect to the nomination and, if so, certain information concerning the solicitation. All candidates (whether identified internally or by a stockholder) who, after evaluation and recommendation by the Nominating and Governance Committee, are then nominated by the Board will be included as the Board's recommended slate of director nominees in the Company's proxy statement.

In addition to submitting potential candidates for consideration by the Nominating and Governance Committee, any stockholder of the Company may nominate one or more individuals for election as a director of the Company at an annual meeting of stockholders if the stockholder sends a notice to the Company's Secretary at the Company's headquarters, in the form specified in the Bylaws, by the date specified in the "Stockholders' Proposals" section of the previous year's proxy statement for nomination of directors. The procedures described in the prior paragraph are meant to establish an additional means by which certain stockholders can have access to the Company's process for

identifying and evaluating Board candidates and is not meant to replace or limit stockholders' general nomination rights in any way.

Each of the nominees for director other than Mr. Gluck and Mr. Corcoran, servedwas elected to serve as a director prior toat the last annual meeting of stockholders. The Nominating and Governance Committee identified Mr. Gluck as a director candidate through a third party search firm retainedstockholders, except for Reuben E. Slone, who was elected by the Board of Directors.effective June 1, 2019. The Board selected Mr. Slone by working with a national search firm. Mr. Slone was selected for his business acumen and supply chain expertise. Mr. Corcoran is beingwas nominated as a directorto the Board pursuant to the terms of a Cooperation Agreement described below.

Cooperation Agreement

Pursuant to the terms of a Cooperation Agreement, dated as of October 1, 2017 (the "Cooperation Agreement"), among the Company, Jeereddi II, LP, Purple Mountain Capital Partners LLC and certain of their affiliates, the Company agreed to nominate James T. Corcoran for election to the Board at the 2017 Annual Meeting. Under the terms of the Cooperation Agreement.Agreement, Mr. Corcoran agreed to offer his resignation to the Board if at any time the Jeereddi/PMCP Group no longer beneficially owned at least 533,344 shares of the Company's common stock (subject to adjustment for stock splits, reclassifications, combinations and similar adjustments, the "Minimum Ownership Threshold"). In addition, so long as the Jeereddi/PMCP Group met the Minimum Ownership Threshold, the Jeereddi/PMCP Group was entitled to certain replacement rights during the Standstill Period (as defined below) in the event Mr. Corcoran is unable to serve as a director.

Also under the terms of the Cooperation Agreement, Jeereddi II agreed to irrevocably withdraw its notice of nomination of candidates for election at the 2017 Annual Meeting. In addition, each member of the Jeereddi/PMCP Group agreed that it would not, directly or indirectly, (i) nominate or recommend for nomination any person for election at the 2018 Annual Meeting, (ii) submit proposals for consideration or otherwise bring any business before the 2018 Annual Meeting, or (iii) engage in certain activities related to "withhold" or similar campaigns with respect to the 2018 Annual Meeting.

The Cooperation Agreement also provided that at the 2018 Annual Meeting, each member of the Jeereddi/PMCP Group would cause all shares of the Company's common stock beneficially owned by them to be present and voted (i) in favor of all of the directors nominated for election by the Board, (ii) in favor of the appointment of the Company's independent registered accounting firm for the years ended June 30, 2019, respectively, and (iii) in accordance with the Board's recommendation with respect to the Company's "say-on-pay" proposal, provided, however, that to the extent that the recommendation of both Institutional Shareholder Services Inc. ("ISS") and Glass Lewis & Co., LLC ("Glass Lewis") differed from the Board's recommendation with respect to any matter other than nominees for election as directors to the Board, the Jeereddi/PMCP Group had the right to vote in accordance with the recommendation of ISS and Glass Lewis with respect to such matters.

Further, under the terms of the Cooperation Agreement, each member of the Jeereddi/PMCP Group agreed to certain normal and customary standstill provisions during a standstill period, which was defined as the period beginning on the date of the Cooperation Agreement and through the later of (x) the date that is the first day to submit stockholder nominations for the 2019 annual meeting of stockholders pursuant to the Company's Bylaws (the "2019 Advance Notice Date") and (y) the date that Mr. Corcoran no longer serves on the Board; provided, however, that if Mr. Corcoran resigned for any reason prior to the 2019 Advance Notice Date, the Standstill Period would continue until the 2019 Advance Notice Date (the "Standstill Period").

Among other things, the standstill provisions provided that, during the Standstill Period, each member of the Jeereddi/PMCP Group would not, among other things, solicit proxies or consents regarding any matter to come before any annual or special meeting of stockholders, or enter into a voting agreement or any group with stockholders other than affiliates of the Jeereddi/PMCP Group and current group members. In addition, each member of the Jeereddi/PMCP Group would not seek to

make, or encourage any third party in making, any offer or proposal with respect to any tender offer, merger, acquisition, amalgamation, recapitalization, restructuring, disposition, spin-off, asset sale, joint venture or other business combination involving the Company and will not seek, or encourage any person, to submit nominees in furtherance of a contested solicitation for the election or removal of directors.

Each of the parties also agreed to certain mutual non-disparagement obligations, and the Company agreed to reimburse the Jeereddi/PMCP Group for its reasonable, documented out-of-pocket fees and expenses, including legal expenses, occurred in connection with the matters related to the negotiation and execution of the Cooperation Agreement, up to a maximum of $25,000.

On July 24, 2019, the Parties amended and restated the cooperation agreement ("A&R Cooperation Agreement") to extend the term of the Standstill Period during which the Jeereddi/PMCP Group will remain subject to certain previously disclosed normal and customary standstill provisions, and extend and continue certain other matters related to annual meetings of the stockholders and the continuing service of James T. Corcoran on the Board.

Pursuant to the A&R Cooperation Agreement, the Company will nominate Mr. Corcoran for election to the Board at the 2019 Annual Meeting of Stockholders and the Standstill Period will be extended through the later of (x) the date that is the first day to submit stockholder director nominations for the 2021 Annual Meeting of Stockholders pursuant to the Company's Bylaws (the "2021 Advance Notice Date") and (y) the date that Mr. Corcoran no longer serves on the Board; provided, however, that if Mr. Corcoran is not re-nominated by the Board for election at the 2020 annual meeting of stockholders, the Standstill Period shall end thirty (30) days following the conclusion of the 2020 Annual Meeting of Stockholders; and provided, further, that if Mr. Corcoran resigns for any reason prior to the 2021 Advance Notice Date, the Standstill Period shall continue until the 2021 Advance Notice Date. In addition, the A&R Cooperation Agreement continues to provide that if the Jeereddi/PMCP Group no longer beneficially owns at least 533,344 shares of the Company's common stock, Mr. Corcoran will offer his resignation to the Board and the Jeereddi/PMCP Group will no longer be entitled to replacement rights in the event Mr. Corcoran is unable to serve as a director. The A&R Cooperation Agreement also extends the agreement by the Jeereddi/PMCP Group to vote in favor of certain matters at the 2019 and 2020 annual meetings of stockholders.

Director Independence

NASDAQ listing standards require our Board of Directors to be comprised of at least a majority of independent directors. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with the Company which would interfere with the exercise of independent judgment in carrying out of his or her responsibilities as a